Tracing Separate Property in Ohio Divorce Law

In an Ohio divorce, the division of assets follows the principle of equitable distribution, where property is divided fairly, though not necessarily equally. One of the key steps in this process is determining whether certain assets are classified as marital property or separate property. While marital property is subject to division, separate property is not. However, proving that an asset is separate property often requires a legal process known as tracing.

Understanding how separate property is traced is essential to protecting assets in a divorce.

What is Separate Property?

Under Ohio law, separate property includes assets that belong solely to one spouse. These assets are generally not subject to division during a divorce. Examples of separate property include:

Property owned before the marriage

Any asset that a spouse acquired prior to the marriage.

Gifts or inheritances

Property or money received by one spouse as a gift or inheritance, regardless of whether it was acquired during the marriage.

Personal injury compensation

Compensation awarded to a spouse for personal injuries, except for any portion meant to cover lost wages during the marriage.

Passive appreciation

The increase in value of separate property that occurs without active contribution from either spouse, such as market-driven growth in the value of stocks or real estate.

While separate property is not divided in a divorce, the burden is on the spouse claiming the property as separate to prove that it is not part of the marital estate. This is where tracing comes into play.

The Importance of Tracing Separate Property

Tracing is the legal process used to identify and establish that a particular asset, or a portion of an asset, is separate property. This can be straightforward if the asset is clearly distinguishable, such as a piece of real estate owned before the marriage. However, in many cases, assets are mixed or commingled with marital property during the marriage, making it more difficult to establish their separate nature.

For example, if one spouse had a savings account before the marriage but continued to make deposits into that account using marital income, the funds in the account may be considered commingled. In such cases, tracing is necessary to differentiate the separate property from the marital property.

Common Situations Requiring Tracing

There are several situations where tracing is necessary to protect separate property in an Ohio divorce. Some of the most common include:

Bank Accounts

When separate funds are deposited into a joint account or when both marital and separate funds are placed in the same account, the original separate property may become commingled. Tracing can help identify the original separate funds and distinguish them from marital assets.

Real Estate

If one spouse owned a home before the marriage but the couple used marital funds to pay the mortgage or make improvements, the home may be considered part separate and part marital property. Tracing can be used to determine the proportion of the home’s value that remains separate property.

Investment Accounts

Increases in the value of investment accounts held prior to the marriage can be difficult to categorize. If the appreciation in value is passive (e.g., market-driven growth), it may be considered separate property. However, if marital funds were used to contribute to the account or if active management during the marriage contributed to the increase in value, tracing is needed to separate the marital portion from the separate portion.

Business Interests

If one spouse owned a business before the marriage, any increase in the value of the business during the marriage might be considered marital property if the business was actively managed by either spouse. Tracing can help identify the pre-marital value of the business and protect it as separate property.

How Tracing Works

To trace separate property, detailed financial records are crucial. Courts often require clear documentation to support the claim that an asset is separate and has not been significantly commingled with marital property.

Common methods used to trace separate property include:

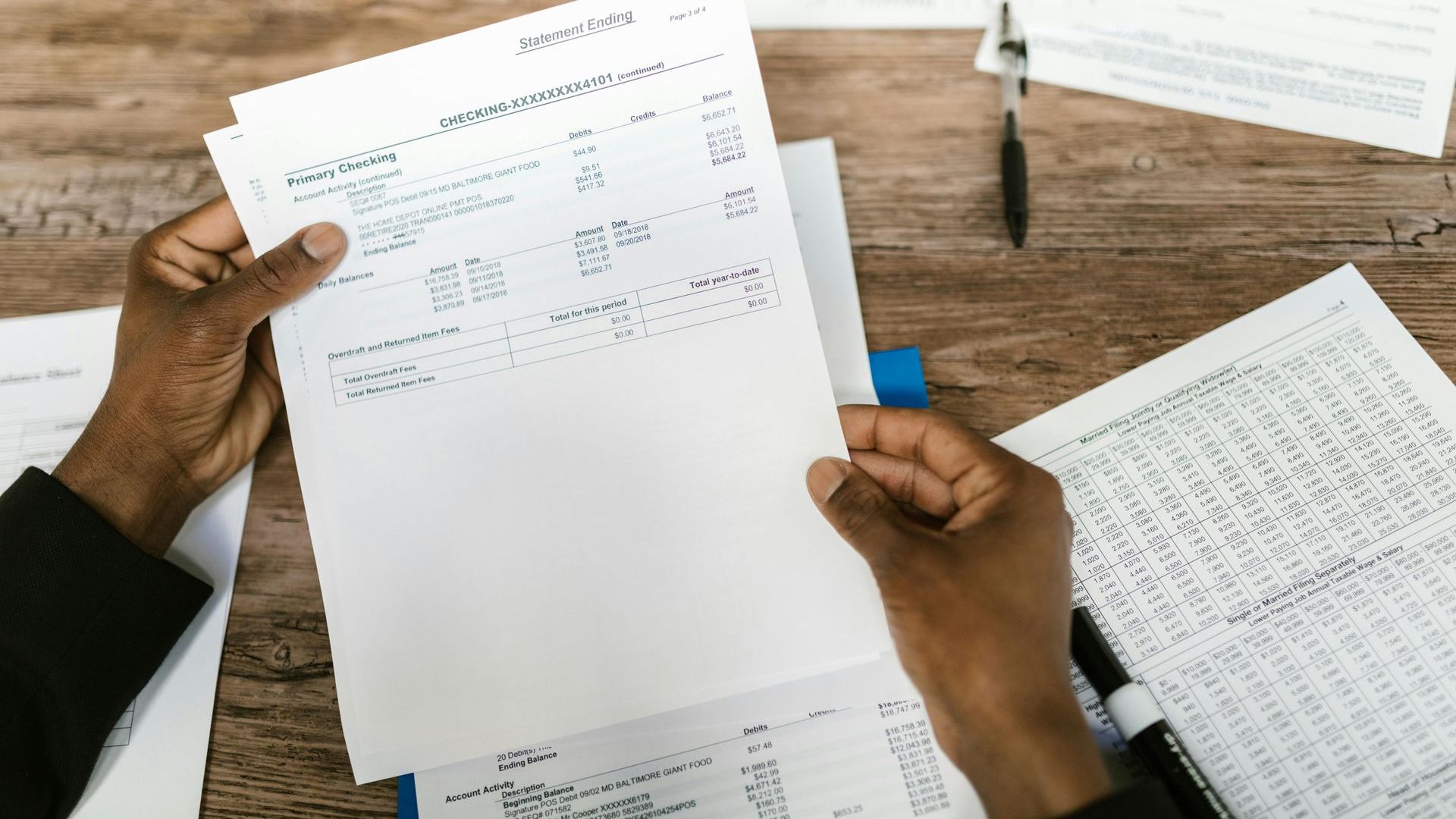

Bank statements and financial records:

These documents are essential in proving the source of funds used to purchase assets or make payments. For example, if separate funds were used to make a down payment on a home or to fund an investment, these records will help demonstrate the origin of the funds.

Purchase receipts and appraisals:

When physical assets like real estate or valuable personal property are involved, having receipts or appraisals from the time of purchase can help prove that the asset was acquired before the marriage or with separate funds.

Testimony from financial experts:

In cases where tracing involves complex financial instruments or businesses, expert testimony may be necessary to prove that separate property has not been commingled or, if commingling has occurred, to establish the proportion of the asset that remains separate.

Challenges in Tracing Separate Property

While tracing is a powerful tool, it can be difficult, particularly if records are incomplete or if assets have been significantly commingled with marital property. Ohio courts generally take the position that if separate property cannot be clearly traced, it may be treated as marital property. This makes maintaining proper documentation throughout the marriage crucial for anyone seeking to protect separate property in the event of divorce.

Some common challenges include:

- Lack of records: Over time, records may be lost or incomplete, making it difficult to trace the origins of an asset. Without clear documentation, it can be challenging to establish separate ownership.

- Significant commingling: When separate and marital funds are used interchangeably to acquire, maintain, or improve an asset, the court may consider the asset to be marital property. The more intertwined the finances are, the harder it becomes to distinguish separate from marital property.

- Active contributions: If the separate property’s value increased during the marriage due to the active involvement of either spouse, the increase may be considered marital property. For example, if one spouse actively managed a pre-marital investment portfolio or business and significantly increased its value, the appreciation may be treated as marital.

Tracing Separate Property for Real Estate

One of the most common and complex scenarios for tracing separate property arises with real estate, particularly the marital home. Real estate can start as separate property but later become commingled with marital property through mortgage payments, home improvements, or refinances during the marriage. Tracing is crucial for proving which portion of the home is separate and which is marital.

Example: The Marital Home

Consider the following scenario: One spouse purchased a home before the marriage, making it their separate property. However, during the marriage, both spouses contribute to mortgage payments, renovations, or improvements using marital funds. In this case, the home may have both separate and marital property components. Tracing helps to distinguish how much of the home’s value remains separate property and how much has become marital property due to the contributions during the marriage.

Key Factors in Tracing the Marital Home

When tracing separate property for the marital home, several factors come into play:

Methods for Tracing Real Estate

To successfully trace separate property for real estate, especially the marital home, it is crucial to gather detailed financial records and other documentation. The following tools are often used to trace real estate:

Closing documents and mortgage statements:

These records can demonstrate how much equity the home had before the marriage and whether mortgage payments were made from separate or marital funds.

Bank statements and financial records:

If separate property was used to pay for home improvements, renovations, or mortgage payments, financial records can help demonstrate that these payments were made from non-marital funds.

Appraisals and property tax assessments:

Appraisals conducted before and during the marriage can show how the property’s value has changed over time and can help distinguish passive appreciation from marital contributions.

Challenges in Tracing Real Estate

While tracing can protect separate property, it is not without challenges. Courts in Ohio generally require clear documentation to prove that an asset, or a portion of an asset, is separate. Without sufficient evidence, the court may treat the property as fully marital. The following issues often arise when tracing real estate:

Commingling of funds: If both marital and separate funds are used to pay for a property or its improvements, it can be difficult to distinguish what portion of the property remains separate. Courts may find that significant commingling of funds transforms the separate property into marital property.

Insufficient records: If the spouse claiming separate property does not have adequate records—such as bank statements, receipts, or mortgage documents—proving the property’s separate status may be impossible. Courts are more likely to classify property as marital if the ownership status cannot be clearly traced.

Active contributions: If one or both spouses made significant improvements to the property during the marriage, those contributions may be considered active, meaning they added value to the property. The portion of the increase in value attributable to these efforts is likely to be considered marital.

Tracing separate property for real estate, especially the marital home, is a critical process in Ohio divorce cases where ownership and contributions have been commingled over time. Properly tracing the source of funds and the nature of improvements can protect a spouse’s separate property rights and ensure that marital property is fairly divided.

Protecting separate property in an Ohio divorce requires a detailed understanding of tracing and the ability to prove that certain assets are not subject to division. At Parks Legal, we are experienced in helping clients trace their separate property and protect their financial interests during divorce. Whether you are concerned about commingled assets or need assistance gathering the necessary documentation to support your claims, we are here to guide you through the process.

If you have questions about how your property will be divided in a divorce or need assistance tracing separate property, please contact to schedule a consultation.